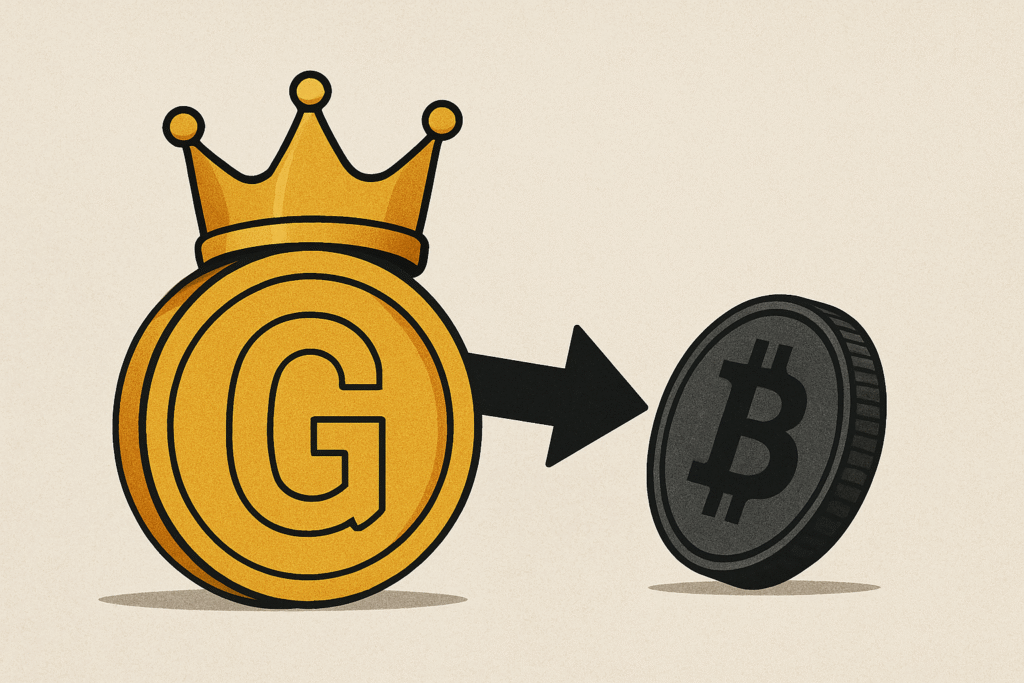

Gold has just pulled off one of the biggest financial upsets of the year, soaring to a record valuation of over $30 trillion and knocking Bitcoin off its perch as the market’s top-performing store of value.

This week, the yellow metal surged past $4,350 per ounce, as global uncertainty and geopolitical tensions propelled investors to hedge their bets on gold again. Further fueling the rally is the growing expectation that the U.S. Federal Reserve could finally cut interest rates.

Bitcoin, on the other hand, seems to be losing its shine this “Uptober.” The leading cryptocurrency has struggled to keep pace with gold’s explosive move, with capital shifting toward safer assets instead of risk-heavy digital ones. The gap between the two is now wider than ever, and this reality is making some crypto traders nervous about the rest of October.

However, not everyone thinks the rally is over. Some analysts believe gold’s rise is simply part of a short-term flight to safety, while Bitcoin is quietly preparing for its next major breakout. Industry figures like Bitcoin enthusiast Samson Mow argue that Bitcoin’s next leg up could even outpace gold’s record climb, especially as long-term holders continue to accumulate.

For now, gold’s stunning $30 trillion valuation cements its place as the world’s ultimate haven. But with markets as unpredictable as ever, crypto fans are holding onto one hope that Uptober still has a little magic left. According to data from coingecko, Bitcoin currently trades below the $106,000 mark, showing that the bears continue to dominate the bulls.