The crypto market plummeted by almost 5% in the last 48 hours, as Bitcoin and ETH were hit hard. According to data from CoinGecko, the crypto market cap shed almost a billion dollars in the last two days.

Bitcoin fell below $110,000 after motoring towards $120,000 on Friday following Powell’s Fed rate “dovish” cut speech. At press time, BTC is struggling to sustain a break into the $110,000 mark as a strong rejection continues to keep it bound to the $109,000 region. Meanwhile, in the past 24 hours, Bitcoin has seen a 1.5% dip.

Ethereum chart data shows a similar decline, albeit stronger. After trading close to an all-time high of $5,000, it’s now down 4.5% in the past 24 hours. The leading altcoin currently hovers around $4,400, although it is still in the green zone based on its 7-day performance.

Market Whales go on BTC Selling Spree.

A massive sell-off has been spotted in the past few days as recent data shows that market whales have sold about $6 billion worth of Bitcoin. The most recent was a 24,000 BTC sell-off, which triggered the closure of more than $800 million in leveraged positions, per data from Coinglass.

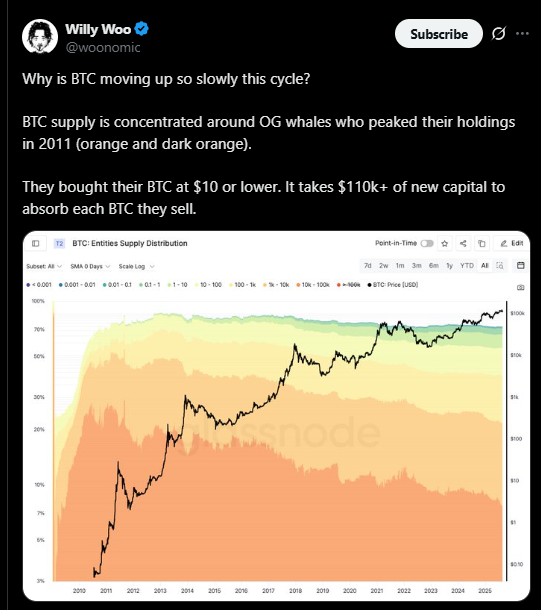

Top analyst Willy Woo analysed how whale rotations are the key reasons for the Bitcoin slump. The analyst stated that new capital is required to cushion the effect of long-term holders who bought BTC at a very low price and are now selling at a huge price of $110,000.

Bitcoin isn’t the only crypto overpowered by the bearish run. Altcoins like Ethereum and Solana are likewise affected. SOL is down 6% and Ethereum follows closely with a 4.5% dip.

Ethereum Set to Lead The Next Bullish Wave

Ethereum has been the target of many crypto whales in the ongoing capital rotation from Bitcoin to Ether. Lookonchain reported a multi-million whale who dumped nearly 23,000 Bitcoin to buy Ethereum and opened an ETH long position of almost $600 million.

A couple more whales have done this, leading to an over 20% rise in Ethereum price in the last 30 days. Compared to Bitcoin’s 3% increase in the same period, Ethereum is definitely seeing more whale demand. If the rate cut comes in September, ETH may reclaim its previous all-time high and rise to new highs, leading the bull cycle.